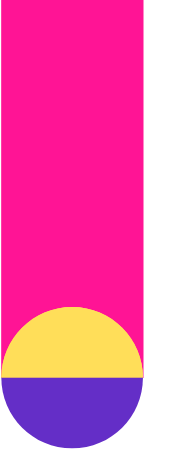

Maximum

Home Price +

$653,551 (a+b)

$1000,000

(a)$451,203

(b)$12000

(c)$4512

(b+c)

+ View Legal Disclaimers

Home price and mortgage amount are high level estimates only based on information provided. This does not constitute a mortgage approval. Results may vary once a formal mortgage application is submitted.

Rates are expressed as best available rates. Qualification is subject to lending criteria of various mortgage lenders who are offering these rates. Lending criteria includes but is not limited to a borrower's credit score, income, property location, down payment, assets and other liabilities, etc.

Private mortgage rates do not include lender fees. Lenders fees may apply depending on borrower's specific situation.

Rates are only applicable to primary residence. For investment property rates please click here.

Rates may be changed, withdrawal, or extended without notice at anytime.

Variable rates are expressed as if calculated monthly, not in advance.

Fixed rates are expressed as if calculated semi-annually, not in advance.

Mortgage Affordability FAQ's

Your Mortgage Affordability Questions Answered

What is Mortgage Affordability?

When it comes to mortgage calculations for affordability, the top question for many First-Time Home-Buyers is "how much mortgage can I afford"?

Mortgage Affordability refers to how much mortgage you can comfortably service. It usually is also the maximum amount of mortgage you can get approved for. Think of it this way - a lender will not want to lend you too much money such that you have to tighten your belt to pay the mortgage.

Mortgage affordability directly impacts the property value you can afford.

Down Payment + Maximum Mortgage You Can Afford = Maximum Home Price You Can Afford

That's why we always recommend you talk to a mortgage broker before you start house hunting. That way you will have a clearer picture on the price range of your "future home".

How to calculate mortgage affordability?

That's the million-dollar question - and also the reason why we created this calculator. Mortgage calculations vary from lender to lender, and it depends on a list of primary and secondary factors. Here's how most lenders calculate mortgage affordability:

Primary factors:

1. Income:

The more you make the more you can qualify. Sounds easy right? Not until you bring debt payments and other expenses into the picture. Generally, the lenders do not want you to spend more than 40-42% of your monthly income on all debt payments, including your mortgage (s).

For full-time salaried borrowers, lenders usually use the average income, including bonus, of the past two years to determine your pre-tax income. For self-employed borrowers, it's a little more complicated as many business owners only take limited money otherDebtPaymentCurrency of their companies. You can refer to this article on how lenders evaluate income for self-employed.

2. Debt:

The more other monthly debt payments you have the less mortgage you can qualify for. For example, if you spend too much of your income paying off credit card balances and your car loan every month, you will have very little room left to afford the mortgage payment.

Debt is included in your mortgage affordability calculation through Debt Service Ratios. The key ratios are TDS (Total Debt Servicing) and GDS (Gross Debt Servicing).

- GDS is your monthly mortgage payment, property tax, and heat, divided by your monthly income

- TDS is your monthly mortgage payment, property tax, heat, and other debt payments (credit cards, car loans, etc.), divided by your monthly income

Usually your GDS should be lower than 35%, and TDS should be lower than 42%. However, if your overall profile is strong, some lenders will allow your TDS to go up to 49%. On the other hand, if your overall profile, such as your credit score and assets you own, is weaker, lenders can restrict your TDS to 40% or lower. If you would like to learn more about it, one of our mortgage advisors is happy to walk you through this over the phone.

3. Property Expenses:

In addition to debt payments, expenses you need to incur related to the property will also be taken into account in your mortgage calculation. These expenses include condo fee (if you are buying a condo), property tax, and heat. They are included in your Debt Service Ratio (TDS & GDS calculation), because these monthly fixed costs also impact how much money you have left to pay for your mortgage.

4. Down Payment:

Down payment represents the equity you put into the home purchase. You need to have down payment because the lender needs to ensure that you "have some skin in the game". So how much down payment do you need?

- 5% is the minimum - Your down payment has to be at least 5% of the home price. At 5%, you will need to purchase mortgage default insurance from CMHC or one of the insurers. Default insurance premium ranges between 2.8% to 4% depending on the down payment you have as a % of your home price.

- 20% is recommended - you will no longer need to purchase default insurance if you have 20% down payment. For certain types of properties, such as rental properties, you need to have at least 20% down payment. This means, having 20% will not only save you money, but also gives you more options on the types of property you are able to purchase.

Secondary factors:

To calculate your mortgage affordability, lenders often look to the following factors to supplement the primary factors. For example, if you have a high debt service ratio, but your credit score is very high, the lender usually makes an exception for you.

1. Assets:

The assets most lenders care about is your "liquid assets" in addition to down payment. Lenders do tend to favor borrowers who have a bit of "war chest" saved up. Because as we all know, sometimes life happens. Having certain levels of saving helps you to make mortgage payments if there is a temporary bump.

Liquid assets include your savings (GIC's) and investments (stocks and bonds). If they are sitting in a registered account, like RRSP, lenders usually discount it by 20%-30% to take into account of tax deductions.

2. Credit score:

Your credit score is a main factor to determine whether you will "get approved for a mortgage or not". It does not necessarily impact "how much mortgage you can get".

How many times your salary can you borrow?

4 to 5 times, but with a lot of qualifiers. It really depends on how much other debt payments you have in addition to the mortgage. For how debt payments impact your mortgage affordability, please refer to the response to the "How to calculate mortgage affordability"?

Based on a 40% TDS ratio and 25 years of amortization, you can generally borrow 4-4.5x your income.

How to improve your mortgage affordability?

As you may have read in the "How to Calculate Mortgage Affordability" FAQ, your income and debt payments are the two main factors that affect your mortgage affordability. Therefore, increasing your income and decreasing your debt payment is the sure way to increase how much you can borrow. Of course, it's easier said than done. It's not like anyone can just walk into their boss' office to ask for a raise tomorrow. However, there are things you can do to reduce your debt.

For example, if you are patient, save up your money to purchase a car vs. leasing goes a long way in creating more "room" for your mortgage. Start creating a budget for your credit card spending can also help you reduce your credit card balance, which in turn creates "room" for your mortgage payment.

How to use the mortgage affordability calculator?

The goal of this calculator is to provide you with an estimate on how much mortgage you can afford. It can then be used as a benchmark when you go house hunting.

To calculate your mortgage affordability, simply input your income, expenses, credit score, and debt payments. We embedded notes in the calculator to guide you through the process. If you do not have the information handy, simply provide an estimate.

We recommend you add +/- 10% from the estimated "max property price" as your budget when start looking for a house. The last thing you want is to bid on a house that you cannot afford. Having a realistic range in mind allows you to make informed decisions when shopping for a home.

If you have more questions on mortgage affordability, please feel free to book a 15-minute quick chat with one of our experienced advisors.